Starting from 2030, plastic packaging will have to contain a specified percentage of recycled material sourced from post-consumer waste recycling. Currently, collection, sorting, and recycling capacities for plastic packaging in Europe will not be sufficient to meet the projected demand for recycled materials. So, what needs to change?

The Circular Economy for Flexible Packaging (CEFLEX) initiative has been at the forefront of analysing and modelling the impacts of the upcoming European Union Packaging and Packaging Waste Regulation (PPWR). How much recycling capacity will be required? What sorting and recycling technologies? What qualities need to be met for recycled content? What are the end markets which will use the recycled materials?

CEFLEX recently supported active stakeholder Natureef, a Polish association, and their own experts deliver a webinar series to explore PPWR requirements and the roadmap ahead for Polish packaging, food, and recycling companies.

The webinar series is just part of a growing collaboration picture in Poland, with an in-depth compositional analysis conducted and supported by fellow stakeholder Orlen also recently completed and being analysed. For CEFLEX, this is a key part of an increasing collaboration with various country level initiatives and stakeholders as implementation of PPWR and ‘operationalisation’ of the circular economy takes place 2025-2030.

This article covers the requirements to meet recycled content and recycling rate targets and the challenges it will bring, plus an interview with Jaśmina Solecka, president of Natureef. The themes explored below reflect exchanges held during late 2024 webinars and tackle issues relevant to anyone striving to meet and support PPWR. Reporting by Natureef with input from CEFLEX.

Recycled Content: How Will Demand for PCR Evolve and Increase?

Policies like the EU Packaging Waste Regulation recycled content targets provide a clear market signal and obligation to use more recycled materials. While other trends and factors are in play, these regulatory drivers are the key catalyst for accelerating recycled content adoption.

PPWR distinguishes between packaging for products that come into contact with sensitive items, such as food or cosmetics, and packaging that does not.

For contact sensitive packaging, legislation mandates a 10% share of recycled post-consumer recyclate (PCR – as opposed to PIR from manufacturing processes) by 2030. Non-contact sensitive packaging will need to hit 35% recycled content targets.

CEFLEX experts outlined three basic scenarios for PCR demand, with the mid-demand scenario based on total annual compound growth of flexible packaging market of 1% per year.

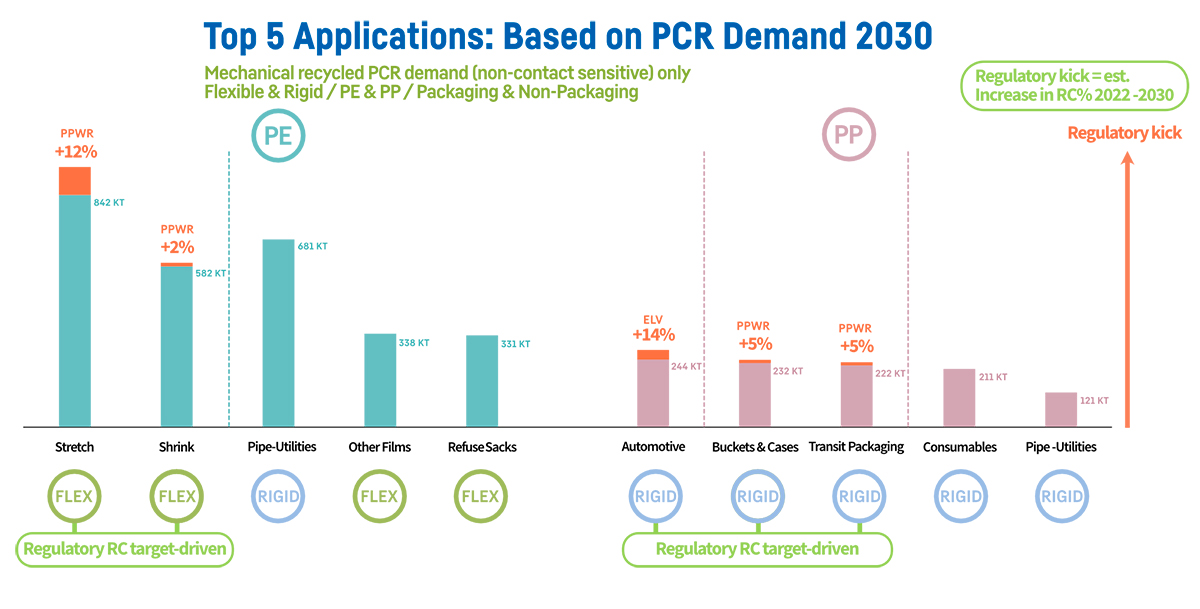

Using this mid-demand baseline indicates a total estimate demand for post-consumer recyclate across all products and applications of 8.4 million tonnes in 2030 for PE, PP and PO applications in EU+3 countries, with packaging accounting for 54% of this (4.5MT).

By CEFLEX’s analysis, Marshall explained during the webinar that 9% of this total 2030 PCR demand (720,000 tonnes) will be contact-sensitive and 14% (1.2 million tonnes) will be mixed polyolefin (PO) for use in less demanding products and applications.

The remaining 6.5 million tonnes of total PCR demand in 2030 is for non-contact sensitive applications Marshall explained. Compared to 2022 figures, both packaging and non-packaging applications in PP and PE shows demand for an additional 1.5 million tonnes for non-contact PCR by 2030.

“It is important to consider that PCR will also be of interest to other industries, such as automotive, not necessarily focused on meeting the same quality requirements for packaging. This is something to be aware of, especially for companies obliged to meet 35% PCR content in their packaging. Ensuring availability and appropriate high-quality standards of PCR could be challenging” warned CEFLEX’s James Marshall.

Increasing Recycling Capacities: An Urgent and Essential Pillar of Achieving PPWR

CEFLEX has also been busy modelling the required recycling capacities and technologies to achieve the PPWR recycling rate and recycled content targets, using its Möbius model, developed with support from researchers at Ghent University in Belgium.

Möbius maps material flows and infrastructure required to develop the circular economy for flexible plastics using over 80 inputs and assumptions to build a probability model. It draws on different growth scenarios, market intelligence, academic analysis and expert judgement from across the value chain to give a range of recycling capacity required rather than a fixed point.

Recycled content targets – 2030

The model estimates that to achieve a first wave of 2030 mandatory recycled content targets, Europe will require a total mechanical recycling capacity for plastic flexible packaging in 2030 of between 2.2 to 4.3 million tonnes (currently 2.4 million tonnes) and 1.3 to 2.9 million tonnes for rigid packaging (currently 1.5 million tonnes).

The model estimates that to achieve a first wave of 2030 mandatory recycled content targets, Europe will require a total mechanical recycling capacity for plastic flexible packaging in 2030 of between 2.2 to 4.3 million tonnes (currently 2.4 million tonnes) and 1.3 to 2.9 million tonnes for rigid packaging (currently 1.5 million tonnes).

Chemical recycling capacity in Europe today is below 100,000 tonnes a year, yet to help achieve 10% food and contact sensitive recycled content targets, Möbius scenarios forecast a range of 600,000 to 1.2 million tonnes for flexible packaging and 0.8 million to 1.5 million tonnes for rigid packaging will be required. Conclusion: Europe may need a combined chemical recycling capacity of around 2 million tonnes, implying a need to increase production capacity by 20 times across the continent to meet PPWR targets

Recycling rate targets – 2035

According to Matt Georges, an economist modelling future scenarios and requirements for flexible packaging at CELFEX, this is a challenging but achievable task. A much greater challenge will be meeting the recycling targets set by PPWR, under which 55% of plastic packaging waste must be recycled by 2030 and all flexible packaging by 2035:

“The required recycling capacities for mechanical recycling are in the range of 5.5–9.1 million tonnes for flexible packaging and 4.2–7.0 million tonnes for rigid packaging. This means that Europe’s mechanical recycling capacities will have to triple within ten years,” he says, adding that the levels for chemical recycling will likely not change significantly once 10% recycled content in food contact packaging is achieved . This is because chemical recycling, due to the anticipated higher cost of recycled plastics produced via this route, will almost certainly only be used to meet the minimum legal obligations, such as ensuring required levels of food contact recyclate in packaging before plateauing he explained.

Recycling rates require significant boosts to collection and sorting

Achieving recycling rate targets for flexible packaging remains a significant challenge the speakers agreed. “A simple calculation shows that to reach a 55% recycling level, 82% of plastic waste must be collected, 82% of it must be sorted, and 82% of that must be recycled” explained Matt Georges. This means that in parallel to the boost in recycling capacity, a transformation in separate collection rates of flexibles across Europe will also have to take place.

Achieving recycling rate targets for flexible packaging remains a significant challenge the speakers agreed. “A simple calculation shows that to reach a 55% recycling level, 82% of plastic waste must be collected, 82% of it must be sorted, and 82% of that must be recycled” explained Matt Georges. This means that in parallel to the boost in recycling capacity, a transformation in separate collection rates of flexibles across Europe will also have to take place.Where to Get More PCR?

What can be done to ensure that Europe has access to recycled materials and recycling capacities to meet the PPWR recycled content targets?

The message was clear – good design is the foundation for achieving circularity. “We need to design packaging in a way that helps optimise every stage of sorting, recycling, and the production of higher quality recyclates. Clear principles of sustainable design, such as the ‘Designing for a Circular Economy’ guidelines exist to help companies make this happen” says James Marshall. He believes that improved sorting and recycling technologies will also be a key part of the solution – including chemical recycling of flexible packaging.

In terms of food-contact and contact-sensitive PCR, rules relating to how recyclate from chemical recycling are attributed – mass balance – are currently a stumbling block for accelerating its deployment in Europe. James Marshall also references Extended Producer Responsibility (EPR) as a vital ‘organiser’ of circular economy ambitions; well-placed to give linear, consistent rules, transparent costs and reducing gaps in waste collection and infrastructure.

Navigating PPWR – assessment, guidance, action

“Polish companies aware of the challenges related to post-consumer recyclate targets are eager to act based on data provided by CEFLEX”, says Jaśmina Solecka, president of Natureef. “Our webinars featuring experts in technology, law, and the market help assessment and give guidance to the market and company representatives across Poland – so having their input and collaboration to establish a way forward really added value” she says.

“Polish companies aware of the challenges related to post-consumer recyclate targets are eager to act based on data provided by CEFLEX”, says Jaśmina Solecka, president of Natureef. “Our webinars featuring experts in technology, law, and the market help assessment and give guidance to the market and company representatives across Poland – so having their input and collaboration to establish a way forward really added value” she says.

Natureef is helping companies in Poland prepare to meet the requirements PPWR. “It’s a several-step process that requires knowledge of regulations and technological expertise – starting with design for recycling, conducting audits of packaging and technologies, assessing compliance with requirements, collaborating with suppliers and so on. All the way to testing new processes and products” she explains.

For companies that are making changes to comply with the PPWR, Natureef has prepared a package of materials and information, including, among others, a guide to the requirements of the PPWR regulation.

“Ensuring we have the latest insights and targeted forecasts and assessments from CEFLEX – and supporting them on their drive to make PPWR and the circular economy a reality across Europe – is fundamental to the future of flexible and other types of packaging. We all need to collaborate and take informed, targeted action together” adds Ms. Solecka.

“CEFLEX is continuing its work across the value chain to help companies, EPR operators and organisations understand what is needed to comply with the PPWR targets and by when. This work is showing that to meet a 55% plastic recycling rate target by end 2030 will require huge increases in mechanical, physical and chemical recycling capacities. Beyond this, we need to understand a further vital question… who will use all this additional recycled plastic and will it still be cheaper than the virgin plastic alternative? Plenty of reason to continue our analysis and activation of the circular economy. I would encourage all flexible packaging players to get involved in CEFLEX for a critical 2025-2030 – we can only do this together”