A CEFLEX stakeholder-only session in March 2023 highlighted different stakeholder views and expertise to inform CEFLEX positions and advocacy on EPR in a global context ahead of the next round of UNEP intergovernmental negotiations on a Global Treaty to End Plastics Pollution.

In our first report from this enlightening CEFLEX stakeholder-only session, we covered some of the tensions, trends and challenges for EPR in the Global South. Let’s now cover more of the views from Ghana, Chile, India, a brand owner and the informal sector in more detail – with additional examples in Brazil, Mexico, Columbia and more.

Panellists at the debate

EPR is a powerful tool with traction around the world and an essential part of solving the plastic pollution problem. However, it is not a silver bullet and works best when matched with infrastructure and policies related to waste management and circular economy underlined many on the panel. This is not always the case, especially in the global south, where a lack of finance, access to expertise and a significant informal sector all play a role.

In Ghana, for example, Oiver Boachie, Special Advisor to Ghana’s Minister of Environment, Science, Technology and Innovation shared that 70% of plastic value chain actors are informal – such as food producers and not just at the waste management stage – meaning that there is no system to trace who is placing products on the market and in what quantities. This makes it challenging to implement a requirement for EPR fees to be collected from producers. If the fees are paid only by the formal sector, huge amounts of packaging will be unaccounted for.

“I think we ought to be very careful in trying to just take what is happening in Europe and other places, and then placing them in the global south context. Because the two areas are completely different in terms of so many factors. In Europe, and other places, markets are very structured” expressed Mr. Boachie. “When we are trying to come up with EPR schemes that will have the same or better effect for these markets, we have to take cultural practices and more into consideration” he continued.

Indeed, Ghana is proposing a sort of ‘global EPR scheme’ that would be funded by a levy on plastic producers (not producers of products) and pay for management of all waste streams – not just plastics and packaging. An approach inspired in part by the ‘pollution gap’ concept. The fund, it is claimed, could generate up to $300 Billion a year to help fund development of a comprehensive waste management system and infrastructure. Just how such a global fund for waste management would resource and drive effective EPR schemes would be up to each country to define and decide Mr. Boachie explained.

From the Ghanian perspective, every country in the global south needs significant funding to bridge the gap between volumes of plastics produced annually and legacy pollution and the world’s capacity to manage, recycle and reuse the resulting waste.

Graphic source: Derek Stephenson, Strategy Matters

The informal sector – critical to address in the global south

In addition to informal actors in supply chains, millions of people in developing countries act as informal actors in managing waste. These actors – waste pickers – depend on this activity for their livelihoods. Waste pickers are demanding fair wages and working conditions and a level playing field with the formal waste management sector, so that they can compete. They are also seeking transparency in the development and implementation of EPR schemes to ensure that they are supported in terms of infrastructure, to get training, certification and financial support.

Soledad Mella, member of the International Alliance of Waste Pickers and President of the Chilean association of Waste Pickers, gave valuable insight on this critical issue.

For Ms Mella, the success of the UN treaty and need for industry to improve its production by eliminating polluting plastics that are not recoverable were essential; but inclusive models of plastics management will continue to be fundamental for the more than 20 million waste pickers worldwide to continue to recover plastics under fair and safe conditions.

“There is a need for transparency in the (UN Global Treaty) negotiations that are currently taking place in our continent” she said. “In Latin America, more than 4 million waste pickers are a primary link in the waste management chain, must be integrated and given recognition through national policies”.

She heralded Chile’s approach as a possible example to replicate as long as the EPR model is properly implemented, as the EPR law has formally included waste pickers.

Today, although it is early days for the process of certified (formalized) waste pickers; many will be watching closely to see how the process works – and what effect it has on the overall performance and functioning of collection and waste management.

EPR trends and adoption in Latin America

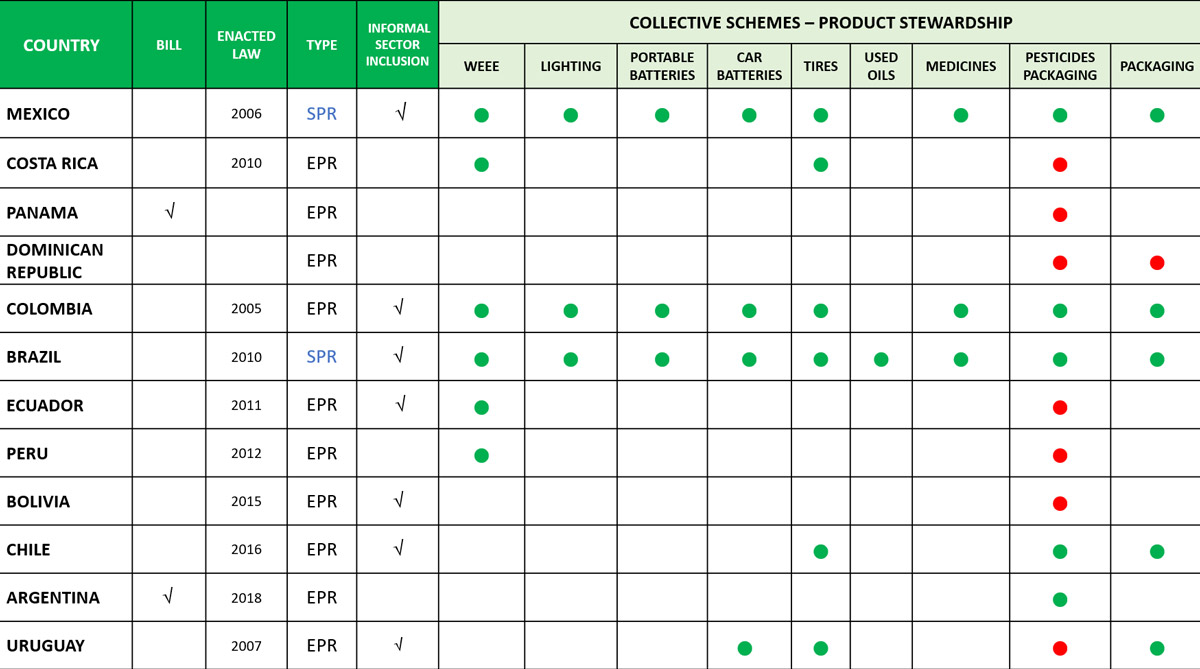

A leading expert in EPR across Latin America and beyond, Rodrigo Leiva Neumann gave the panel an essential overview of adoption and implementation across the continent.

The Director-General of EPR and circular economy consultancy Valoryza, Chile, is also chair of the International Solid Waste Association’s Governance and Legal Issues group and the PREVENT Waste Alliance.

“We have lots of EPR regulations across Latin America, but only a few systems are really operating – and that is a big issue in our region” he began. “Added to this, there is a real diversity in the type of system. In Brazil and Mexico, something approaching EPR is applied; a system of shared product responsibility, where the producer is not really the leading body or entity, but they have been doing very well – especially in Brazil – regarding waste picker recognition and inclusion”.

“Another example is Colombia, where an EPR system has been operational since 2021. Complete with recycling targets and compliance schemes. For the moment, these recycling targets are not specific and for all types of materials. So, some improvement to ensure plastics are managed correctly, but I think they will, in the future, become precise.”

Speaking about his own country, Chile, Mr. Neumann outlined the rather robust EPR regulations and approach – but also areas of progress still to make.

“The Chilean model is very close to the EPR approach in Europe. Solid regulations with waste pickers as a strategic stakeholder with rights and obligations. We have a pretty good baseline for collaboration with the informal sector, but we need some more elements to facilitate a fair transition and recognition”.

So, what is missing? “Waste pickers need a fair price for their services and to be supported through regulation, training certification and financial support to compete with traditional waste management companies. This opens up issues of competition and who and how a modern waste infrastructure is financed, which is a connected and additional area to navigate with a political dimension to it” Rodrigo remarked.

“If I had to pick the top items EPR in Latin America needs: political will, resources for governmental agencies, consistent progress, recognition of the informal sector and regulation enforcement” he finished.

© Valoryza

A recent report from the Inter-American Development Bank on the ‘Financial sustainability of solid waste management in Latin America and the Caribbean’ sets out the situation in stark terms.

“Less than ten years after the Sustainable Development Goals (SDGs), the countries of Latin America and the Caribbean (LAC) have a substantial challenge in the solid waste sector. Nearly 65 million people do not have access to solid waste management, recovery rates (4%) are the lowest compared to other regions of the world and 40% of waste is disposed of in unsuitable sites. Bridging this gap requires taking action in the short term and allocating the financial resources needed to achieve this improvement” it states.

The results of the publication’s analysis indicate that an average of US$13.4 billion per year and an estimated figure of US $ 34,000 million over the next eight years is needed to achieve the proposed SDG goals for 2030 – with the bulk of this in infrastructure development, operation and maintenance.

India’s approach to EPR

A system of EPR trading certificates and targets in four different categories of packaging is central to the Indian approach described by waste management consultant Kartik Kapoor of GIZ India.

“India very recently – February 2022 – announced its EPR policy which came up as a law and this policy of plastic packaging is basically focusing on four categories. Rigid, flexibles, multi-layer and compostable” explained Kartik.

And the method the Indian system has adopted for settling of this obligation? “Basically, the trading mechanism is very similar to the carbon trading mechanism, where the certificates, which we call as EPR certificates, are generated and traded further between the producers and brand owners” he continued.

“Indian law identifies defined categories of who qualifies to become a plastic waste processor and the producer and brand owners are given the obligation. So, the plastic waste processors are able to generate recycling certificates for the plastic packaging material. And these certificates are then sold to the brand owners at a market rate to generate revenue for the EPR scheme”.

Targets driving EPR in India include obligations on:

- Reuse of rigid packaging (Brand owners) (2025+)

- Use of recycled plastic (2025+)

- Fulfilling EPR obligations through recycling (2024+)

The panel and audience were keen to quiz Mr. Kapoor on how such market-based instruments and certification schemes work in practice; highlighting the transparency and integrity of tradable certificates.

“The Indian system has come up with a monitoring mechanism where they have multiple checks” he explained. “One at the time of registration and then the centralized reporting on the processing capacity and sharing the production details by a plastic waste processor and then followed by third party auditors, which ensure that the actual recycling has happened on the field” Kartik outlined.

Brand owner perspectives on EPR around the world

Last, but not least, Global Circular Packaging Director at MARS, Feliks Bezati brought some of the key elements from a brand owner perspective to life.

“We know today that the recycling infrastructure especially for plastic packaging – and even more so for flexible plastic packaging – needs to be subsidized. What is extremely important for us, is to help ensure the best possible performance for this investment”.

It has led to MARS and many other brand owners to be increasingly implicated in the collection, sorting and recycling of waste around the world and, consequently, EPR.

Mr. Bezati shared some analysis and characteristics of EPR and recycling infrastructure performance in Belgium, Portugal, USA and Indonesia to help pinpoint the key ingredients that make a “North Star” (ambition) for brand owners such as Mars to be guided by and aim for.

“We need to be clear about what an effective EPR looks like and how it operates to best support it. The ‘North Star’ for circularity requires regulations, optimal EPR with industry led PROs, segregated collection and a given budget” he explained.

Consumer sustainability awareness, ownership of recycling infrastructure – with a brand owner stake preferred – and regulations all complement EPR to give the complete picture he outlined.

Type of collection is also an important piece of the puzzle he underlined. “At the global level we do not have a harmonized way of collection. This is extremely important, not only because it will make the life of citizens much easier, but also because not all types of collection have the same impact on recycling efficiency. For instance, collection of paper and flexible packaging in the same time can lead to cross-contamination of both recycling streams respectively.”

Another particularity for flexibles, raised by Mr. Bezati and other members of the panel, included how waste pickers understandably approach lighter materials. “As important as the informal sector can be, when it comes to collecting and processing flexibles, they do not bring the same value as a PET bottle and the informal sector will be less interested”. It is significant challenge to ensuring all packaging and materials are properly managed and recycled.

Extended collection, eco-modulated EPR systems where each type of packaging pays a fee and automized sorting and recycling lines able to process lighter materials effectively are the ideal situation for flexibles, even in the global south the brand owner suggested. Something Bezati stresses is possible, has been shown to work, and closely correlated to well defined and managed EPR systems.

Scratching the surface

If the picture is complex in Europe, this event served to show it could be even more complex and challenging to ensure effective, high-performance EPR schemes in the global south.

Meaningful policies and regulations to create them are developing though, and the UN Global Treaty is further underlining just how important EPR can be in reducing plastic pollution, managing waste and driving material circularity around the world.

Transferring experience from more established EPR experiences in the north will be a real challenge; but there is also plenty of opportunity to bypass some of the mistakes in conception and deployment suggested moderator Derek Stephenson closing the session.

“Even with our rich examples and experts today, we are indeed scratching the surface on a very, very fascinating discussion, and one that will accelerate with the next meeting in Paris for the Intergovernmental negotiating committee (INC) on plastic pollution in May-June this year”.

CEFLEX looks forward to supporting the discussions to meet our #MissionCircular vision and treaty goals. Stay tuned for more.